Stochastics

The Basics

Stochastics is used to identify market strength, overbought/oversold.

Indicator Type

Momentum oscillator

Markets

All cash and futures, not options

Works Best

Flat markets or trading ranges

Formula

The calculation (fast) tells us where price is in its recent range. It is then smoothed with a 3-period moving average (slow) leaving both lines on the chart.

Most traders smooth the smoothed line again to create a slower version of the indicators.

Parameters

Most traders and markets use a period of 14 although 9 periods and 20 period values are used to make the values sensitive, respectively.

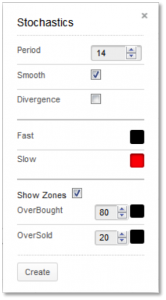

Technician defaults to a period of 14 with 3-period smoothing in both fast and slow versions. If the “divergence” box is checked the software identifies possible conditions of price moving one way and stochastics moving the other.

The “Show Zones” box allows the user to draw overbought and oversold lines on the plot. They default to 80 for overbought and 20 for oversold but can be changed by the user.

You can also select colour for the stochastics plot (basic and smoothed and slow) and two zone lines by selecting the boxes next to each to bring up a colour palette.

Theory

A stochastic is the measurement of the placement of a current price within a recent trading range. The theory is that as prices rise, daily (or hourly, minute, etc.) closes tend to occur closer to the high end of their recent range. When prices trend, higher or are flat and daily closes begin to sag within the range, it signals internal market weakness.

Interpretation

Values above 80 or below 20 are potential market signals. Aside from smoothing out fluctuations, the moving average adds two other dimensions to the analysis. Crossovers between the two lines and divergences between the stochastic and the price trend, both within the overbought and oversold ranges, provide additional evidence of reversals in the market.

The unsmoothed stochastic will tend to show many crossovers and therefore could show false signals to the inexperienced user of this technique. The smoothed version, often called the slow version, will show fewer crossover signals, but each one is more likely to catch true near-term market reversals. One caution would be that extreme readings in strongly trending markets could be continuation, not reversal, signals. This study is better suited to slower market conditions.

Commonwealth Bank, shown here in weekly format, traded in a flat range for several months in 2016 after having a couple of choppy months. Stochastics made a higher low in October to signal internal strength was growing.

After it broke out in November, the stock rallied very sharply. Stochastics was pinned in the overbought region, but it was not a signal to sell since this indicator was not designed to work in strong trends.

Math

Calculates where price is within a recent range.

- Fast calculation (%K) uses raw value with a simple moving average

- Slow (smoothed) version (%D) uses the simple average with another simple average of the first

Fast %K = (Current Price – Lowest Low) / (Highest High – Lowest Low)

Fast %D = 3-period simple moving average of Fast %K

Slow %K = Fast %D

Slow %D = 3-period simple moving average of Slow %K

Lowest Low = lowest low for the past N-periods including current

Highest High = highest high for the past N-periods including current