Schaff

The Basics

The Schaff Trend Cycle Indicator is the product of combining Slow Stochastics and the Moving Average Convergence/Divergence (MACD). The MACD has a reputation to be a trend indicator, yet it has an equal reputation to be lagging due to its slow responsive signal line. The improved signal line gives the STC its relevance as an early warning sign to detect currency trends.

Indicator Type

Trend

Markets

All cash and futures, not options

Works Best

Trending markets

Formula

The Schaff Trend Cycle detects up and down trends long before the MACD. It does this by using the same exponential moving averages (EMAs), but adds a cycle component to factor currency cycle trends. Since currency cycle trends move based on a certain amount of days, this is factored into the equation of the STC Indicator to give more accuracy and reliability than the MACD

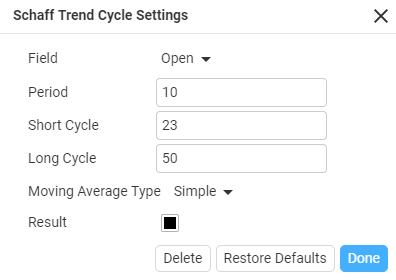

Parameters

Theory

Schaff Trend Cycle Indicator was developed primarily for fast markets, particularly currency markets, yet it can be employed in any market.The trend in the modern day is to develop more accurate, reliable and early warning signal detectors to follow prices more accurately using the old models. The invention of the computer made it able to capture speed, accuracy and reliability of prices more uniformly, because the computer eliminated the need to calculate long equations using pen and paper. So, any new modern indicator will always have.

However, as reliable as the STC Indicator may be, never will an indicator be perfect. The reliability factor may be higher but slight problems exist because of the STC’s ability to stay in overbought and oversold markets for extended periods. For this reason, the STC Indicator should be used for its intended purpose: to follow the signal line up and down and take profits when the signal line hits bottom or top. Eventually another signal will generate.

Interpretation

James hardy had choppy period from November to late December 2014, until it has a sharp uptrend. The SCT detected the increase of buying and price rise before it when into overbought. It also detected in middle of January 2015 that volume increased, and the price decreased starting the downward price trend into an oversold trend.

Maths

The technical code for the STC works like this.

Inputs: TCLen (10), MA 1 (23), MA 2 (50).

Plot 1 (_SchaffTC(TCLen.MA1, MA2), Schaff_TLC.

Plot 2 (25).

Plot 3 (75